Class04¶

Datastream¶

Overview¶

Another important data platform for accounting and finance research

Useful for international research

A product offered by Refinitiv (formerly known as Thomson Reuters)

Access¶

Where to find Eikon terminal¶

Terminal in CASIF office

Bloomberg trading room (LUBS Room 1.30)

How to login¶

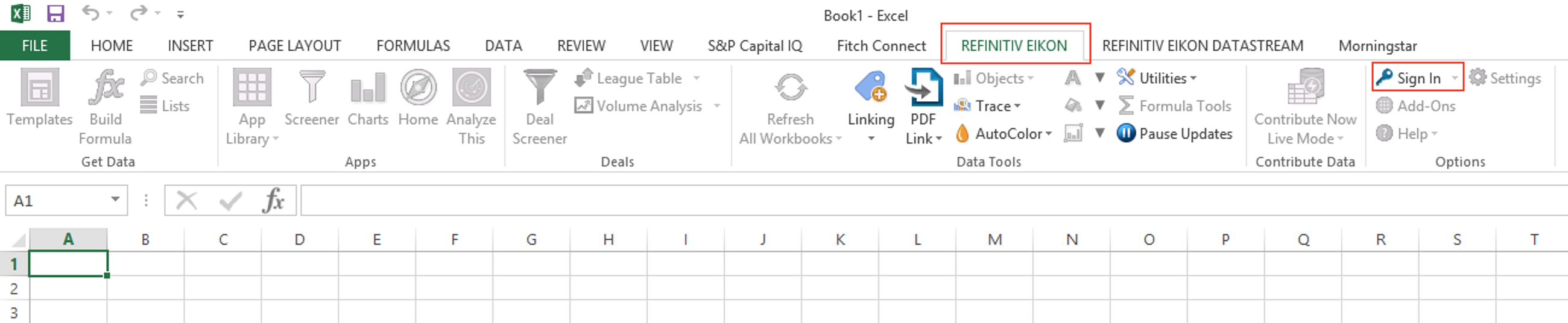

1. Open Excel

2. Click REFINITIV EIKON

3. Click Sign In

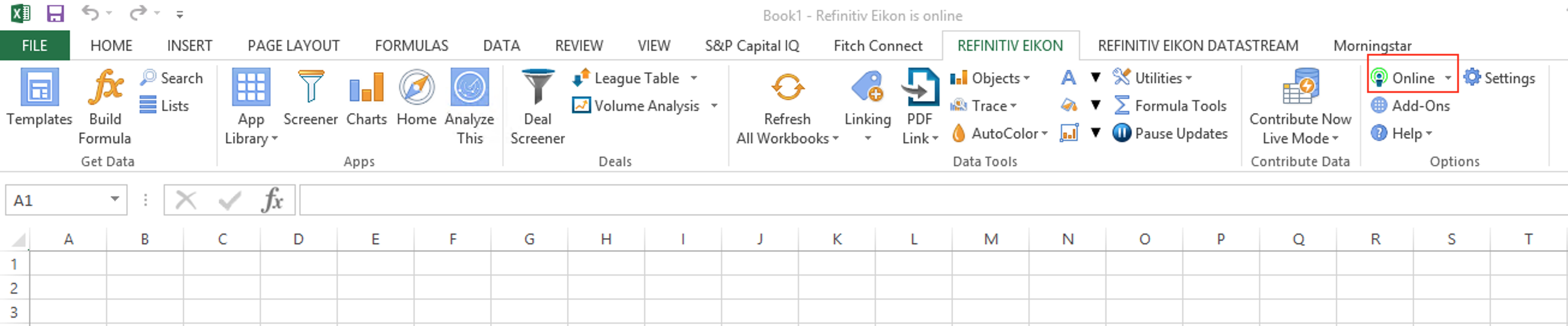

4. Online means successful login

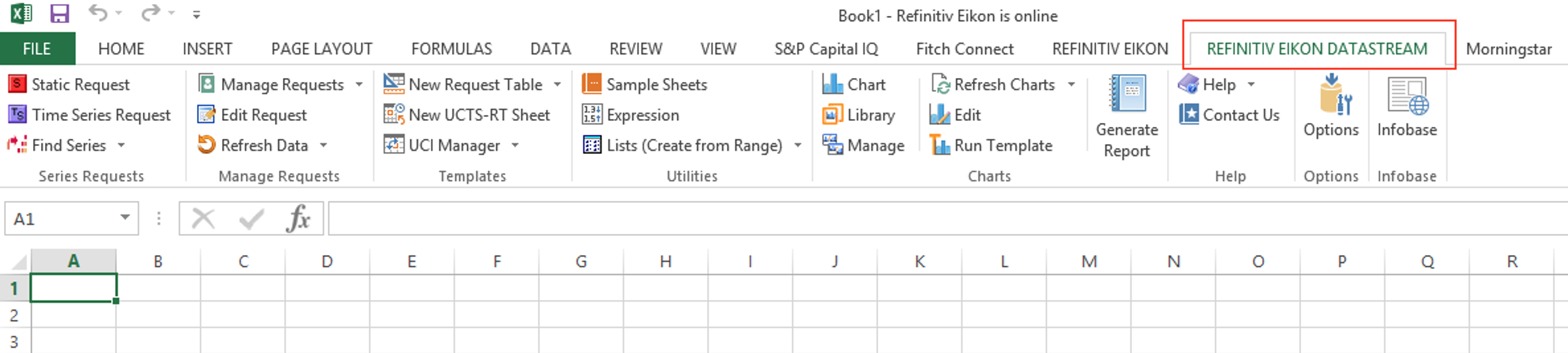

5. Click REFINITIV EIKON DATASTREAM

Company list¶

How to screen company list¶

Name |

DS symbol |

CUSIP |

ISIN |

Primary |

Major |

Exchange |

|---|---|---|---|---|---|---|

ALPHABET INC |

@GOOGL |

02079K305 |

US02079K3059 |

P |

Y |

Nasdaq |

ALPHABET INC |

D:ABEA |

02079K305 |

US02079K3059 |

S |

Y |

Frankfurt |

ALPHABET INC |

0RIH |

02079K305 |

US02079K3059 |

S |

Y |

London |

ALPHABET INC |

@GOOG |

02079K107 |

US02079K3059 |

P |

N |

Nasdaq |

Name |

DS symbol |

CUSIP |

ISIN |

Primary |

Major |

Exchange |

|---|---|---|---|---|---|---|

ALPHABET INC |

@GOOGL |

02079K305 |

US02079K3059 |

P |

Y |

Nasdaq |

Primary - ISINID returns either P or S where P indicates that the equity record is the primary one (i.e., the domestic listing of the share or depository receipt or certificate), and where S indicates that the equity record is secondary (i.e., a foreign listing of a share or depository receipt or certificate).

Major - For companies with more than one equity Security MAJOR returns Y (yes) or N (no) to indicate which of the securities is the most significant in terms of market value and liquidity of the primary quotation of that security. Only one security per company is assigned as the major, and all quotations of that security will return a Y value. All quotations of other securities will return N. For Companies with only one equity security, all the quotations of that security will return Y.

Company list from other database¶

You are able to use your own list if you have firm list from some other databases (for example, you may have a list from Compustat). Acceptable identifiers include:

CUSIP. Please remember to add leading U, e.g. U02079K305

ISIN

IBES ticker

Static data¶

Example: company identifiers

Time series data¶

Example: stock price

Stock price of Tesco

date |

P |

P#S |

|---|---|---|

12/20/2021 |

287.6 |

287.6 |

12/21/2021 |

288.5 |

288.5 |

12/22/2021 |

287.55 |

287.55 |

12/23/2021 |

288.35 |

288.35 |

12/24/2021 |

287.9 |

287.9 |

12/27/2021 |

287.9 |

NA |

12/28/2021 |

287.9 |

NA |

12/29/2021 |

291.05 |

291.05 |

12/30/2021 |

291.25 |

291.25 |

12/31/2021 |

289.9 |

289.9 |

27 Dec 2021 and 28 Dec 2021 are non-trading days (holidays) in UK. The price will repeat last

availabe price on holidays if you choose

See also

You can read this article to get better understanding of the difference Datastream – Price variables

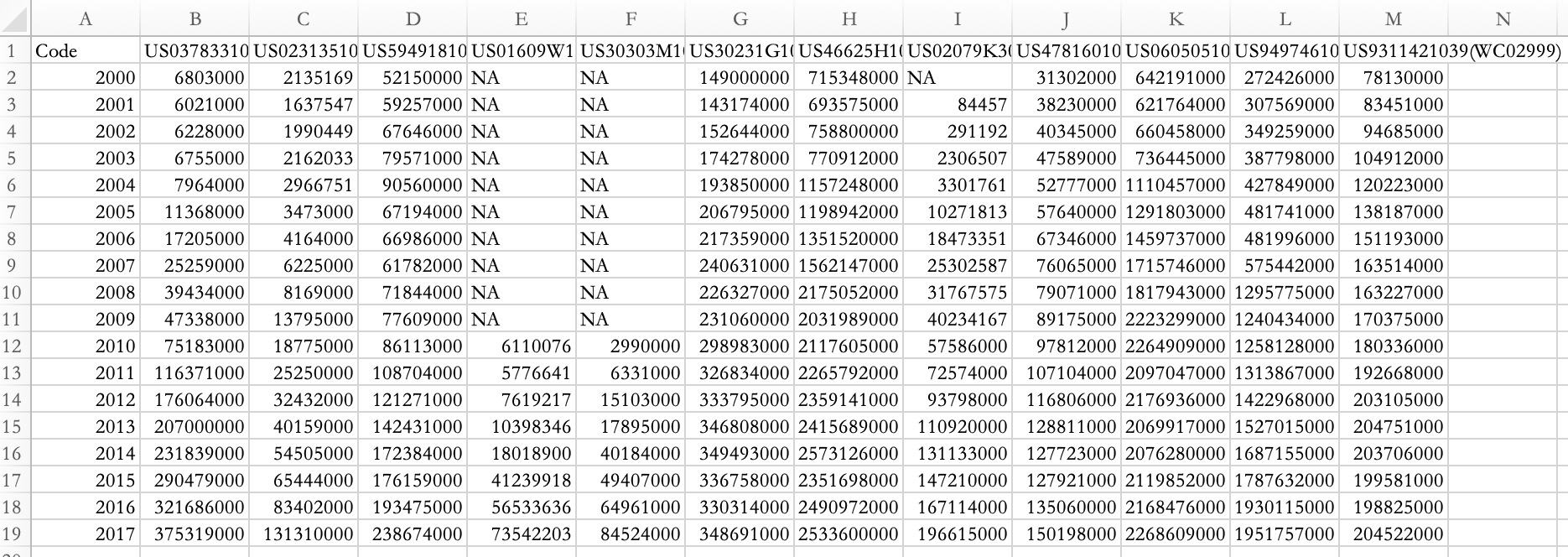

Data format¶

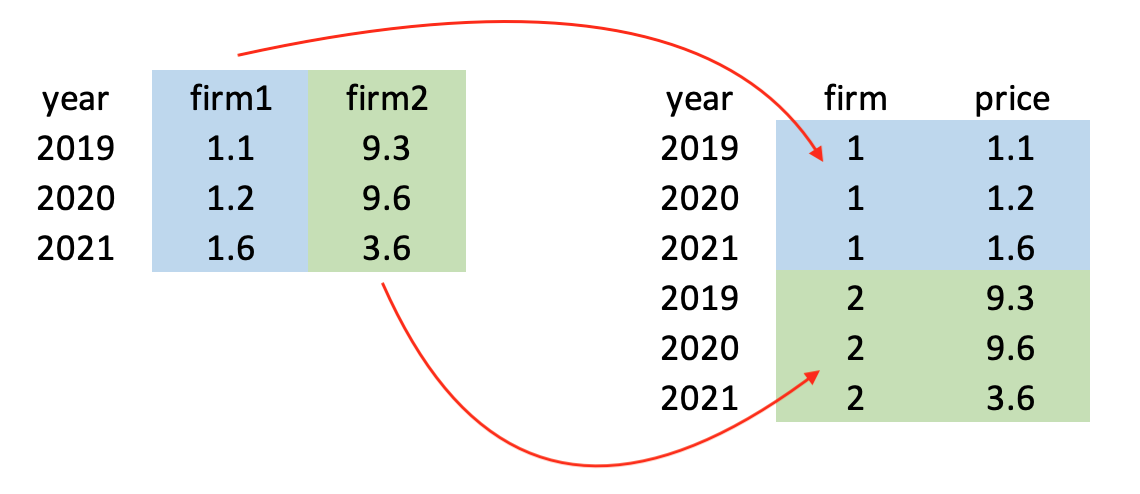

Data from Datastream is not panel data format

We need to transpose data from wide to long before we analyse the data

Let’s assume we have stock price data for two firms.

Python¶

Read firm assets from Datastream

import pandas as pd

import numpy as np

url = 'https://www.dropbox.com/s/3x230qb3fkopij3/datastream_asset.xlsx?dl=1'

asset = pd.read_excel(url, sheet_name='asset')

Transpose data

asset = pd.melt(asset, id_vars='Code', value_vars=asset.columns[1:],

value_name='asset')

asset['isin'] = asset['variable'].str[:12]

asset = asset[['isin','Code','asset']]

asset = asset.rename(columns={'Code': 'year'})

asset.head()

| isin | year | asset | |

|---|---|---|---|

| 0 | US0378331005 | 2000 | 6803000.0 |

| 1 | US0378331005 | 2001 | 6021000.0 |

| 2 | US0378331005 | 2002 | 6228000.0 |

| 3 | US0378331005 | 2003 | 6755000.0 |

| 4 | US0378331005 | 2004 | 7964000.0 |

Stata¶

Read firm assets from Datastream

/* Import firm total asset */

local data_url "https://www.dropbox.com/s/3x230qb3fkopij3/datastream_asset.xlsx?dl=1"

import excel using "`data_url'", sheet("asset") first clear

/* Rename variables */

rename Code year

rename US* assetUS*

/* Convert data type */

destring, replace ignore("NA")

Transpose data

/* Reshape wide to long */

reshape long asset, i(year) j(isin) string

/* Extract ISIN */

replace isin = substr(isin, 1, 12)