# Class02

## CRSP overview

- Data: security price (and many other trading related data)

- Coverage: US stock exchanges

- Time period: 1925 - present

- Frequency: daily and monthly

### Web access

Downlaod data from CRSP via WRDS web access.

- Dataset: CRSP monthly stock file

- Time period: Jan 2011 to Dec 2020

- Search the entire database

- Variables

- shrcd

- exchcd

- siccd

- prc

- ret

- shrout

- cfacpr

- permco

- cusip

- ncusip

- Output format

- Tab-delimited text

- Uncompressed

- Date format: YYMMDDn8

### Identifiers

- PERMNO

- CRSP permanent security level identifier

- They are permanent and never change

- PERMCO

- CRSP permanent firm level identifier

- One PERMCO might have different PERMNO because a company can issue different securities. For example, Alphabet (Google) has class A and class C shares.

- They are permanent and never change

- CUSIP

- Current 8-digit CUSIP (security level)

- They can be changed. And we can use NCUSIP to track the change history.

- NCUSIP

- Historical 8-digit CUSIP (security level)

```{note}

TICKER and company name (COMNAM) are also available identifiers in CRSP. However, we usually do not use them to match stocks/firms unless we have no other widely used identifiers.

```

### Stock exchange code

EXCHCD

- 1

- NYSE

- 2

- AMEX

- 3

- NASDAQ

Chinco, Neuhierl and Weber. (2021). Journal of Financial Economics.

Chinco, Neuhierl and Weber. (2021). Journal of Financial Economics.

Lee and Swaminathan. (2000). Journal of Finance.

Lee and Swaminathan. (2000). Journal of Finance.

See other stock exchange codes here

### Share code

SHRCD

- 10 or 11

- Common stocks

Antoniou, Doukas and Subrahmanyam. (2016). Management Science.

Antoniou, Doukas and Subrahmanyam. (2016). Management Science.

Han, Huang, Huang and Zhou. (forthcoming). Journal of Financial Economics.

Han, Huang, Huang and Zhou. (forthcoming). Journal of Financial Economics.

See other share codes here

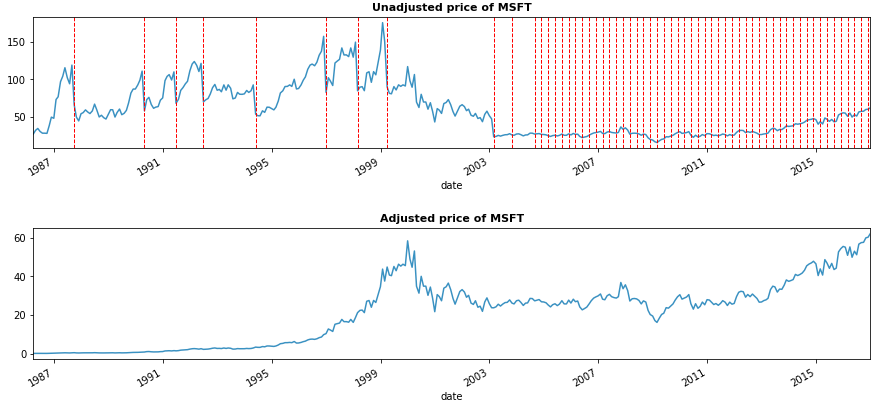

### Stock price

- PRC

- Stock price (unadjusted)

- Some stock prices have negative sign (-)

- Need to take absolute value of price

- $\text{adjusted price} = \frac{\left|prc\right|}{cfacpr}$

- It is important to adjust stock price when evaluating stock performance

Take the example of Microsoft stock price. The vertical red lines indicate corporate actions (e.g. stock splits, dividends). Clearly, the stock return is not correct if unadjusted price is applied.

```{note}

RET (stock return) in CRSP is already adjusted. You can download it and there is no need to do any adjustment.

```

### Market value

$\text{market value (millions)} = \frac{|prc| \times shrout}{1000}$

- SHROUT

- number of shares outstanding (in 1,000 shares)

### Volume

- VOL

- Number of traded shares

- 1 share in Daily Stock File

- 100 shares in Monthly Stock File

## Python

- Import packages

```{jupyter-execute}

import pandas as pd

import numpy as np

```

- Import CRSP raw data

- Import data from local directory

```{code-block} python

# Please make sure to change the path to where you save your data

file_path = '/Users/ml/Dropbox/teaching/data/crsp_month_raw.txt'

crsp_raw = pd.read_csv(file_path, sep='\t', low_memory=False)

# View first 5 rows

# crsp_raw.head()

````

- Import data from a url

```{jupyter-execute}

# This url contains sample data from CRSP

url = 'https://www.dropbox.com/s/6mk86g97uji2f80/crsp_month_raw.txt?dl=1'

crsp_raw = pd.read_csv(url, sep='\t', low_memory=False)

# View first 5 rows and first 5 columns

crsp_raw.iloc[:5, :5]

````

**API reference**: pandas.read_csv

```{attention}

**Comments**

- Any lines starting with `#` will be treated as comments and Python will not execute the lines.

- This is useful when you need to write some comments or notes

**Folder path and operating system**

- Use **pathlib** library is a better solution if you want to run your codes without problem on different operating systems.

- Import the package: `from pathlib import Path`

- MacOS (Linux)

- Forward slash: **/folder/file.txt**

- Windows

- Backslash: **C:\folder\file.txt**

- Please use double slashes when typing path: `C:\\folder\\file.txt`

- Check the folder path tips

```

- Data dimension

```{jupyter-execute}

# Observations

len(crsp_raw)

```

```{jupyter-execute}

# Number of rows and columns (variables)

crsp_raw.shape

```

- Data type

```{jupyter-execute}

# List all variables in the dataset

crsp_raw.columns

```

```{jupyter-execute}

# Data type of variables

crsp_raw.dtypes

crsp_raw.info()

```

```{jupyter-execute}

# Rename uppercase to lowercase

# Typing lowercase is easier than uppercase

crsp_raw.columns = crsp_raw.columns.str.lower()

# Convert data type of date to date format

# So that we can apply date functions when manipulating dates

crsp_raw['date'] = pd.to_datetime(crsp_raw['date'], format='%Y%m%d')

# Convert data type of ret to numerical value

# Stock return should be numerical values rather than string

# For example,

# string: '1' + '2' = '12'

# numerical: 1 + 2 = 3

crsp_raw['ret'] = pd.to_numeric(crsp_raw['ret'], errors='coerce')

# Convert siccd to numerical value

crsp_raw['siccd'] = pd.to_numeric(crsp_raw['siccd'], errors='coerce')

crsp_raw.info()

```

- Stock exchanges and common shares

```{jupyter-execute}

crsp = crsp_raw.copy()

# Keep NYSE/AMEX/NASDAQ

crsp = crsp[crsp['exchcd'].isin([1, 2, 3])]

# Keep common shares

crsp = crsp[crsp['shrcd'].isin([10, 11])]

# Convert shrcd and exchcd to int

crsp[['exchcd', 'shrcd']] = crsp[['exchcd', 'shrcd']].astype(int)

len(crsp)

```

- Drop duplicates

It is a good practice to check if there are duplicated observations.

```{jupyter-execute}

crsp = crsp.drop_duplicates(['permno', 'date'])

len(crsp)

```

**API reference**: pandas.dataframe.drop_duplicates

```{tip}

Categorical data is a good way to reduce the memory usage especially when the data eats up too much your computer memory.

```

```{jupyter-execute}

temp = crsp.copy()

# Convert shrcd and exchcd to category

temp[['exchcd', 'shrcd']] = temp[['exchcd', 'shrcd']].astype('category')

temp.info()

```

**!!!** 38M vs. 80M

- Save data

```{code-block} python

# Remember to change the file path on your machine

outpath = '/Users/ml/Dropbox/teaching/data/crsp_month.txt'

crsp.to_csv(outpath, sep='\t', index=False)

```

**API reference**: pandas.dataframe.to_csv

- Read clean data

```{jupyter-execute}

# If you want to import from local

# file_path = '/Users/ml/Dropbox/teaching/data/crsp_month.txt'

# crsp = pd.read_csv(file_path, sep='\t', parse_dates=['date'])

# Import from url

url = 'https://www.dropbox.com/s/0nuxwo3cf7vfcy3/crsp_month.txt?dl=1'

crsp = pd.read_csv(url, sep='\t', parse_dates=['date'])

```

- Generate new variables

```{jupyter-execute}

# Market value

crsp['price'] = crsp['prc'].abs()

crsp['me'] = (crsp['price']*crsp['shrout']) / 1000

crsp['lnme'] = np.log(crsp['me'])

# Adjusted price

crsp.loc[crsp['cfacpr']>0, 'adjprc'] = crsp['price'] / crsp['cfacpr']

# Holding period returns

crsp['yyyymm'] = crsp['date'].dt.year*100 + crsp['date'].dt.month

# Monthly index

# From 1 to n

# For example, month index will be from 1 to 120 if we have 120 months data

month_idx = crsp.drop_duplicates('yyyymm')[['yyyymm']].copy()

month_idx = month_idx.sort_values('yyyymm', ignore_index=True)

month_idx['midx'] = month_idx.index + 1

crsp = crsp.merge(month_idx, how='left', on='yyyymm')

# Past 6-month returns

crsp['logret'] = np.log(crsp['ret']+1)

crsp = crsp.sort_values(['permno', 'yyyymm'], ignore_index=True)

crsp['hpr'] = (crsp.groupby('permno')['logret']

.rolling(window=6, min_periods=6).sum().reset_index(drop=True))

crsp['hpr'] = np.exp(crsp['hpr']) - 1

crsp['midx_lag'] = crsp.groupby('permno')['midx'].shift(5)

crsp['gap'] = crsp['midx'] - crsp['midx_lag']

temp1 = crsp.query('permno==10028 & 201107<=yyyymm<=201212').copy()

# Replace it by missing if there is month gap.

crsp.loc[crsp['gap']!=5, 'hpr'] = np.nan

temp2 = crsp.query('permno==10028 & 201107<=yyyymm<=201212').copy()

```

**API reference**: pandas.dataframe.loc

**API reference**: pandas.dataframe.query

```{attention}

Pay attention to month gaps when we use information over multiple periods. Your calculation might be right but data might not be always perfect. Do we have past 6-month data when we compute past 6-month returns?

```

```{jupyter-execute}

temp1[['permno', 'yyyymm', 'midx', 'midx_lag', 'gap', 'ret', 'hpr']]

```

```{jupyter-execute}

temp2[['permno', 'yyyymm', 'midx', 'midx_lag', 'gap', 'ret', 'hpr']]

```

Alternative way is to fill the gaps and assume the returns during the gaps are 0. This will keep more valid cumulative returns.

- Summary statistics

```{jupyter-execute}

crsp[['ret', 'lnme']].describe()

```

```{jupyter-execute}

# Percentiles

crsp[['ret', 'lnme']].describe(percentiles=[0.1, 0.9])

```

```{jupyter-execute}

# Summary statistics by year

crsp['year'] = crsp['date'].dt.year

round(crsp.groupby('year')[['ret', 'lnme']].describe()

.loc[:, (slice(None), ['mean', '50%', 'std'])], 4)

```

```{jupyter-execute}

# Summary statistics by stock exchange

round(crsp.groupby('exchcd')[['ret', 'lnme']].describe()

.loc[:, (slice(None), ['mean', '50%', 'std'])], 4)

```

```{jupyter-execute}

# Summary statistics in subsamples

print('Before 2015')

print(crsp.query('year<=2015')[['ret', 'lnme']].describe())

print('\nAfter 2015')

print(crsp.query('year>=2016')[['ret', 'lnme']].describe())

```

**API reference**: pandas.dataframe.describe

## Stata

- Import CRSP raw data

- Import data from a url

```{code-block} stata

local repo_url "https://raw.githubusercontent.com/mk0417/financial-database"

local data_url "/master/data/crsp_demo.txt"

local url = "`repo_url'" + "`data_url'"

import delimited "`url'", clear

```

- Import data from local directory

```{code-block} stata

clear

set more off

cd "/Users/ml/Dropbox/teaching/data/"

import delimited crsp_month_raw.txt, clear

// list first five observations

l permno date shrcd exchcd ret in 1/5

```

```{code-block} stata-output

+------------------------------------------------+

| permno date shrcd exchcd ret |

|------------------------------------------------|

1. | 10026 20201231 11 3 0.072598 |

2. | 10028 20201231 11 2 0.125541 |

3. | 10032 20201231 11 3 0.046848 |

4. | 10044 20201231 11 3 -0.051522 |

5. | 10051 20201231 11 1 -0.030851 |

+------------------------------------------------+

```

- Data dimension

```{code-block} stata

// Number of observations

count

di _N

```

- Data type

```{code-block} stata

describe

```

```{code-block} stata-output

Contains data

obs: 870,692

vars: 12

-------------------------------------------------------------------------------

storage display value

variable name type format label variable label

-------------------------------------------------------------------------------

permno long %12.0g PERMNO

date long %12.0g

shrcd byte %8.0g SHRCD

exchcd byte %8.0g EXCHCD

siccd str4 %9s SICCD

ncusip str8 %9s NCUSIP

permco long %12.0g PERMCO

cusip str8 %9s CUSIP

prc float %9.0g PRC

ret str9 %9s RET

shrout long %12.0g SHROUT

cfacpr float %9.0g CFACPR

-------------------------------------------------------------------------------

Sorted by:

Note: Dataset has changed since last saved.

```

```{code-block} stata

// Convert date to date format

tostring date, replace

gen date1 = date(date, "YMD")

l permno date date1 ret in 1/5

```

```{code-block} stata-output

+-------------------------------------------+

| permno date date1 ret |

|-------------------------------------------|

1. | 10001 20110131 31jan2011 0.028992 |

2. | 10001 20110228 28feb2011 0.022727 |

3. | 10001 20110331 31mar2011 0.072404 |

4. | 10001 20110429 29apr2011 -0.038789 |

5. | 10001 20110531 31may2011 0.028050 |

+-------------------------------------------+

```

```{code-block} stata

// Convert ret to numerical

gen ret1 = real(ret)

drop ret

rename ret1 ret

// Convert siccd to numerical

gen siccd1 = real(siccd)

drop siccd

rename siccd1 siccd

describe

```

```{code-block} stata-output

Contains data

obs: 870,692

vars: 13

-------------------------------------------------------------------------------

storage display value

variable name type format label variable label

-------------------------------------------------------------------------------

permno long %12.0g PERMNO

date str8 %9s

shrcd byte %8.0g SHRCD

exchcd byte %8.0g EXCHCD

ncusip str8 %9s NCUSIP

permco long %12.0g PERMCO

cusip str8 %9s CUSIP

prc float %9.0g PRC

shrout long %12.0g SHROUT

cfacpr float %9.0g CFACPR

date1 float %td

ret float %9.0g

siccd float %9.0g

-------------------------------------------------------------------------------

Sorted by:

Note: Dataset has changed since last saved.

```

- Stock exchanges and common shares

```{code-block} stata

// Keep NYSE/AMEX/NASDAQ

keep if inlist(exchcd, 1, 2, 3)

* Equivalently,

* keep if exchcd==1 | exchcd==2 | exchcd==3

// Keep common shares

keep if inlist(shrcd, 10, 11)

* Equivalently

* keep if shrcd==10 | shrcd==11

```

- Drop duplicates

```{code-block} stata

duplicates drop permno date, force

```

- Save data

```{code-block} stata

save crsp_month, replace

```

- Read clean data

```{code-block} stata

use crsp_month, clear

```

- Generate new variables

```{code-block} stata

// Market value

gen price = abs(prc)

gen me = (price*shrout) / 1000

gen lnme = ln(me)

// Adjusted price

gen adjprc = price / cfacpr

// Holding period return

gen yyyymm = mofd(date1)

format yyyymm %tm

gen logret = ln(1+ret)

sort permno yyyymm

forvalues i=1/5 {

by permno: gen l`i' = logret[_n-`i']

}

gen hpr = logret+l1+l2+l3+l4+l5

by permno: gen yyyymm_lag = yyyymm[_n-5]

format yyyymm_lag %tm

gen gap = yyyymm - yyyymm_lag

replace hpr = . if gap!=5

replace hpr = exp(hpr) - 1

```

- Summary statistics

```{code-block} stata

summ ret lnme

summ ret lnme, d

// Summary statistics by year

gen year = year(date1)

tabstat ret lnme, by(year) stat(mean p50 sd) long

tabstat ret lnme, by(year) stat(mean p50 sd) long nototal

tabstat ret lnme, by(year) stat(mean p50 sd) long nototal col(stat)

// Summary statistics by stock exchange

tabstat ret lnme, by(exchcd) stat(mean p50 sd) long nototal col(stat)

// Summary statistics in subsamples

summ ret lnme if year<=2015

summ ret lnme if year>2015

```